A Person who wishes to enter into a partnership to carry out a business is individually called "Partners"; and altogether, it is called a "Partnership Firm". Law refers to a partnership firm in India based on the Indian Partnership Act of 1932. To establish a Partnership business or firm, partners need to set foot into an agreement which is popularly called a Partnership Deed.

A partnership firm is bonding carried out by partners who have agreed to share a firm's assets carried on by everyone or any individual among them acting for all. In this type of firm, all the partners are agents for each other and the firm. A partnership mainly consists of two essential elements.

Agreement or contract for partnership :

A partnership firm is based on a contract or an agreement between two or more people. The partnership does not arise from status nor operation of law or inheritance but only from a contract that the partners are signing. Hence, at the time of death of the father, who was the partner within the firm, the son or anyone from the family can claim his share in the partnership property but cannot become a partner unless they enter into a contract for an equivalent with another person concerned. Hence, there must be an agreement concerning the sharing of profits.

As in a partnership firm, everyone equally shares its profit and losses; partners have the liberty of deciding the profit and loss ratio in the partnership firm. The partnership firm's profits and turnover depend on their work; partners hold a sense of ownership and accountability. Any loss of the firm partners equally or according to the partnership deed reduces the burden of loss on one partner.

"Business" is used in its broad sense, referring to every trade, occupation, or profession. A partnership firm is a mutual agency rather than sharing of profits. If the element of interactive agency is absent in a partnership firm, there will be no partnership.

The partnership results from a contractor agreement; at least two people are necessary to compose a partnership. As in the Indian Partnership Act, 1932 doesn't refer to anything about the maximum no. of partners required. But a partnership firm including more than ten persons for a banking business is mentioned as illegal. Hence, there should be limits to the number of partners in a partnership firm.

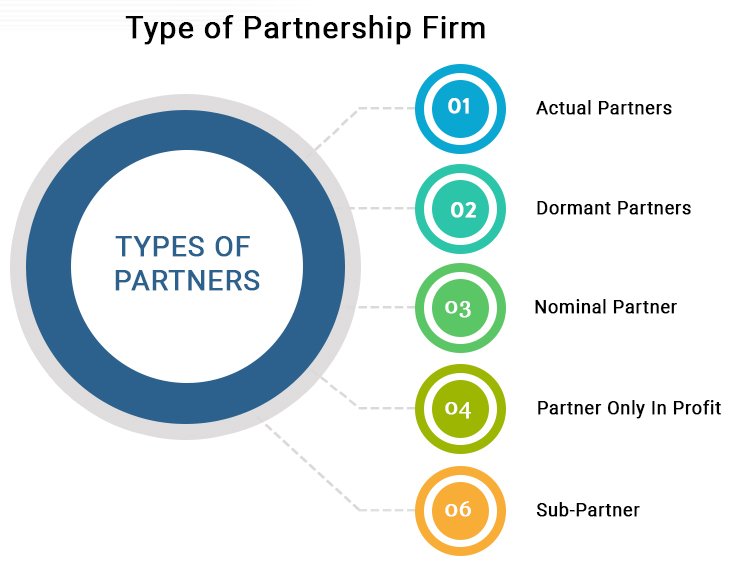

These are the partners by agreement or contract. These individuals actively participate in the conduct of a partnership. This type of partner acts as a representative of other partners for all the acts carried out in the usual business lifestyle of the business.

These partners share their profits and losses and are liable to third parties for the business carried out by the partnership firm.

A nominal partner is an individual who lends his name to the partnership firm; if this is done without any genuine interest in the business, the person is a nominal partner.

A partner who is entitled to share the profits without being liable to the loss as this kind of a partner is liable to third parties only for acts of the gain and for nothing else.

Sub-partner refers to a partner in a partnership firm who agrees to share their profits in a partnership firm with an outsider to the firm. These sub-partners of a firm don't hold any right against the firm, nor are they liable to any debts caused by the firm.